Launching a car insurance business can be a highly profitable and stable venture, especially with the rising demand for auto coverage across the United States. Whether you’re a seasoned insurance agent or a newcomer to the financial services industry, this comprehensive guide will walk you through every step of launching a car insurance agency from scratch.

Contents

- 1 🚘 Why Start a Car Insurance Business?

- 2 🧭 Step 1: Understand the Insurance Business Model

- 3 📝 Step 2: Create a Solid Business Plan

- 4 🏛️ Step 3: Get Licensed and Registered

- 5 💻 Step 4: Choose Your Carriers

- 6 🏢 Step 5: Set Up Your Office and Tech Stack

- 7 📣 Step 6: Build Your Brand and Online Presence

- 8 📊 Step 7: Market Your Agency Like a Pro

- 9 👥 Step 8: Hire and Train Your Team

- 10 💼 Step 9: Manage Operations and Compliance

- 11 🏆 Step 10: Scale Your Car Insurance Business

- 12 📘 Real-Life Example: From Solo Agent to 7-Figure Agency

- 13 🔗 External Resources (For Deeper Learning)

- 14 📌 Final Thoughts

🚘 Why Start a Car Insurance Business?

The U.S. car insurance market is valued at over $300 billion annually, with every state requiring some form of vehicle insurance. This creates consistent demand for auto coverage and related services. Here are the top reasons to get into the car insurance business:

- High recurring revenue from policy renewals.

- Low overhead with a virtual or hybrid agency model.

- Scalable growth through digital tools and automation.

- Opportunity to niche down in areas like luxury vehicles, Uber drivers, or teen insurance.

🧭 Step 1: Understand the Insurance Business Model

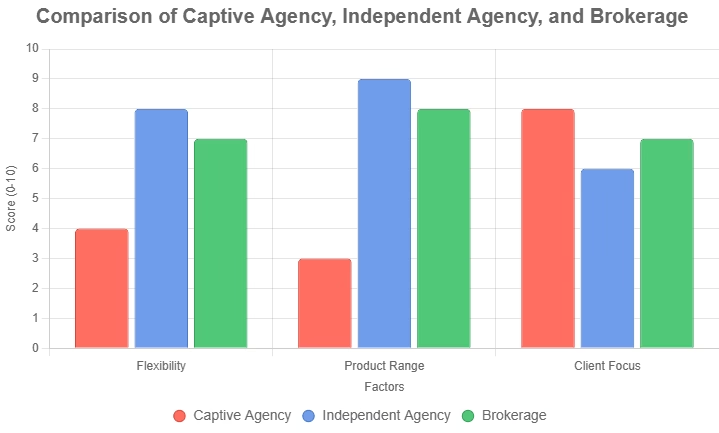

Before you jump in, you must choose your business structure. There are three primary models in the car insurance industry:

1. Captive Agency

- Represents a single insurance company (e.g., State Farm, Allstate).

- Lower startup costs but limited product offerings.

2. Independent Agency

- Represents multiple carriers and has more product flexibility.

- Higher potential income but requires stronger marketing.

3. Insurance Brokerage

- Acts as a matchmaker between clients and carriers.

- Earns commission per sale and may charge brokerage fees.

📝 Step 2: Create a Solid Business Plan

A business plan is your roadmap to success. It should include:

- Executive Summary

- Company Description

- Market Research

- Services Offered

- Sales Strategy

- Startup Costs

- Revenue Forecasts

- Marketing Strategy

💡 Pro Tip: Use tools like LivePlan to simplify the process.

🏛️ Step 3: Get Licensed and Registered

You must fulfill state and federal legal requirements:

✅ Insurance License

To sell car insurance, you need a Property & Casualty (P&C) license. Steps include:

- Complete a state-approved pre-licensing course.

- Pass the P&C license exam.

- Submit fingerprints and background check.

- Apply for licensure via your state’s insurance department.

📌 Check your state’s requirements via the National Insurance Producer Registry.

✅ Business Registration

- Choose a business name.

- Register your LLC or corporation.

- Obtain an EIN from the IRS.

- Open a business bank account.

💻 Step 4: Choose Your Carriers

As an independent agency or broker, you need to partner with insurance carriers. Here’s how:

- Research carrier appetite and financial strength (look for AM Best rating A or higher).

- Apply for an appointment with carriers.

- Sign producer or broker agreements.

- Meet minimum production quotas.

Some popular auto carriers to consider:

- Progressive

- Travelers

- Liberty Mutual

- Nationwide

🏢 Step 5: Set Up Your Office and Tech Stack

🪑 Office Setup Options

- Virtual: 100% remote with cloud-based tools.

- Brick-and-Mortar: Ideal for walk-in traffic in urban areas.

- Hybrid: Combine remote and physical office benefits.

🖥️ Essential Software Tools

| Tool Type | Recommended Tool | Purpose |

|---|---|---|

| CRM | AgencyBloc, Salesforce | Manage client relationships |

| AMS (Agency Mgmt) | EZLynx, HawkSoft | Policy tracking & quoting |

| E-signature | DocuSign, PandaDoc | Contract completion |

| Accounting | QuickBooks, FreshBooks | Bookkeeping & taxes |

| Website | WordPress + Elementor | Online presence |

📸 Image Prompt:

A modern insurance office setup with dual monitors, headset, and a digital CRM dashboard open.

📣 Step 6: Build Your Brand and Online Presence

🚀 Branding Essentials

- Logo and Name: Professional and trustworthy.

- Tagline: E.g., “Drive Protected, Live Confident.”

- Brand Colors: Use calming and reliable tones like blue or green.

🌐 Website and SEO

Create a WordPress website optimized for SEO. Include:

- Home page

- About us

- Services

- Blog (to attract organic traffic)

- Contact form

Use local SEO to rank in nearby areas: “Best car insurance agency in [City]”

📱 Social Media Channels

- Facebook Business Page

- LinkedIn Company Profile

- Instagram for brand awareness

- YouTube for explainer videos

📊 Step 7: Market Your Agency Like a Pro

Marketing is vital in attracting your first 100 clients. Here’s a proven strategy:

📧 Email Marketing

- Build an email list using lead magnets like “Free Auto Insurance Checklist”

- Use Mailchimp or ConvertKit to automate follow-ups.

🧭 Local Advertising

- Sponsor local events.

- Partner with auto dealerships.

- Use yard signs and car magnets.

💰 Paid Ads

- Google Ads with local targeting.

- Facebook Lead Ads for quote generation.

A digital marketing dashboard showing traffic analytics, email campaigns, and ad conversions.

👥 Step 8: Hire and Train Your Team

As your client base grows, you’ll need help. Consider:

| Role | Responsibilities |

|---|---|

| Licensed Agent | Selling policies |

| CSR (Customer Service) | Handling renewals and claims |

| Marketing Assistant | Social media, ads, SEO |

| Virtual Assistant | Admin tasks and follow-ups |

Provide ongoing training and access to your AMS/CRM platform for efficiency.

💼 Step 9: Manage Operations and Compliance

🔍 Compliance Tips

- Stay updated with state insurance laws.

- Maintain E&O (Errors & Omissions) Insurance.

- Store client data securely (use encryption + backups).

📈 Tracking Success

Use KPIs like:

- Policies sold per month

- Retention rate

- Lead-to-sale conversion rate

- Revenue per policy

🏆 Step 10: Scale Your Car Insurance Business

Once your business is stable, here’s how to scale:

🌍 Expand Services

- Add home, renters, or life insurance to become a full-service agency.

🤝 Build Referral Networks

- Collaborate with auto shops, car dealerships, and real estate agents.

📲 Use Automation

- Automate quoting, reminders, and policy renewals with InsurTech platforms.

🏢 Franchise or Open Multiple Locations

Once your SOPs (standard operating procedures) are dialed in, replicate your success across cities or states.

📘 Real-Life Example: From Solo Agent to 7-Figure Agency

Meet Sarah Thompson, who started as a one-woman agency in Dallas, TX. Within 3 years, she:

- Partnered with 5 auto carriers

- Used Facebook ads to generate 300+ monthly leads

- Grew her revenue to $1.2 million annually

- Opened a second branch in Austin

Her success? Consistent client service, strong branding, and smart digital tools.

🔗 External Resources (For Deeper Learning)

- National Association of Insurance Commissioners (NAIC) – for regulatory updates.

- Insureon Guide on Starting an Agency – detailed insights and licensing tips.

- How to Start an Insurance Company – WikiHow – beginner-friendly guide for aspiring founders.

📌 Final Thoughts

Starting a car insurance business is a strategic move in today’s risk-conscious world. With low entry barriers, recurring revenue, and high growth potential, this is your time to enter the industry confidently.

Take it step by step — from licensing to marketing — and focus on building trust with your clients. In the world of insurance, credibility equals profitability.

✅ Key Takeaways

- Get your P&C license and register your business.

- Choose between captive, independent, or broker model.

- Build a professional brand and website.

- Invest in CRM and AMS tools for growth.

- Focus on local SEO, ads, and referrals to acquire clients.

- Continuously optimize, train your team, and scale.

Explplore More @Financialspringboard.com