Contents

- 1 Best ETFs for Beginners USA: Smart Investing for New Investors

- 1.1 What Are ETFs and Why Are They Great for Beginners?

- 1.2 Best ETFs for New Investors in the USA

- 1.3 Real Growth Comparison of Beginner-Friendly ETFs

- 1.4 How to Start Investing in ETFs for Beginners USA

- 1.5 Best ETFs for Long-Term Investment Beginners USA

- 1.6 How to Choose the Right ETF for Beginners USA

- 1.7 FAQs About ETFs for Beginners

- 1.8 Conclusion: Best ETFs for Beginners in the USA

Best ETFs for Beginners USA: Smart Investing for New Investors

Are you a beginner investor looking to grow your money in the stock market? Exchange-Traded Funds (ETFs) are one of the easiest and safest ways to start investing. In this guide, we’ll break down the best ETFs for beginners USA, highlight their benefits, and show you how to get started with confidence.

What Are ETFs and Why Are They Great for Beginners?

An ETF, or Exchange-Traded Fund, is a basket of securities that trades on a stock exchange like a single stock. It allows investors to buy into a diversified portfolio of assets without picking individual stocks.

Top Benefits of ETFs for Beginners:

- Low cost and easy to buy

- Diversification to reduce risk

- Accessible through most brokerage accounts

- Automatic reinvestment and dividend options

Best ETFs for New Investors in the USA

Here are the most recommended beginner-friendly ETFs with low expense ratios USA that are widely trusted and easy to start with:

1. VTI – Vanguard Total Stock Market ETF

- Tracks the entire U.S. stock market

- Over 4,000 companies from all sectors

- Expense Ratio: 0.03%

Why it’s great: Offers exposure to large-cap, mid-cap, and small-cap stocks. A strong choice for long-term investing.

2. VOO – Vanguard S&P 500 ETF

- Tracks the S&P 500 index (top 500 U.S. companies)

- Expense Ratio: 0.03%

- Ideal for passive investors

Why it’s great: Offers high-quality blue-chip companies. It’s perfect for stability and growth.

3. SCHB – Schwab U.S. Broad Market ETF

- Covers over 2,500 U.S. companies

- Expense Ratio: 0.03%

- Commission-free on Charles Schwab

Why it’s great: Low-cost and wide exposure to the U.S. economy. Great for building a diversified base.

- Another excellent S&P 500 tracker

- Expense Ratio: 0.03%

- Highly liquid with strong returns

5. QQQ – Invesco QQQ ETF

- Tracks the NASDAQ-100 index (tech-heavy)

- High growth but more volatile

- Expense Ratio: 0.20%

Why it’s great: Ideal for beginners looking for exposure to top tech and innovation-driven companies.

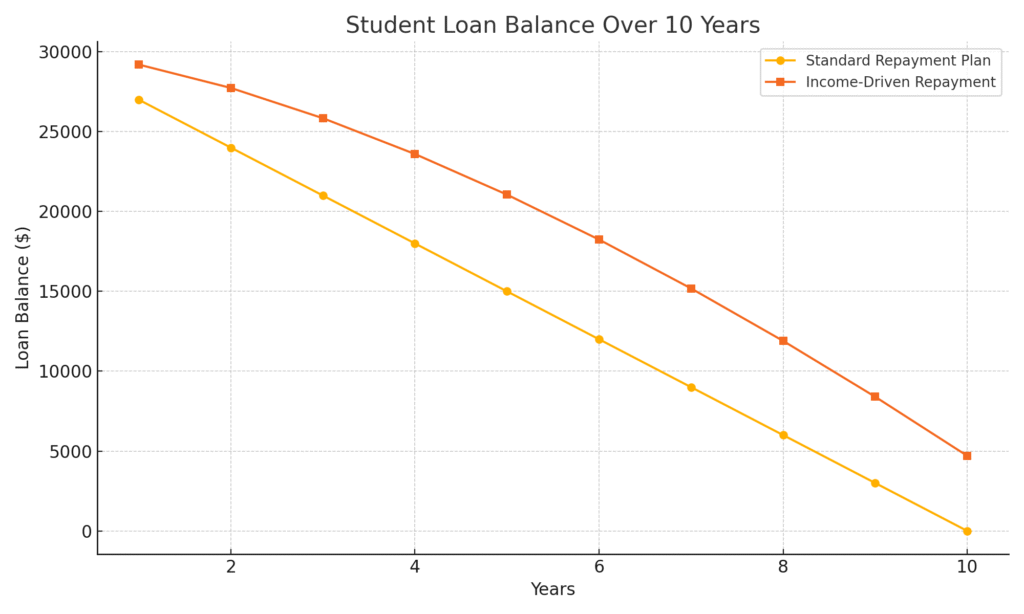

Real Growth Comparison of Beginner-Friendly ETFs

Here’s a look at how $10,000 invested in top ETFs would have grown over the last 10 years:

As shown above, VTI, VOO, and SCHB all demonstrate strong and consistent long-term performance — perfect for beginner investors seeking steady growth.

How to Start Investing in ETFs for Beginners USA

Ready to dive in? Follow these simple steps to get started:

- Open an online brokerage account (e.g., Fidelity, Vanguard, Schwab)

- Deposit funds into your account

- Search for your chosen ETF symbol (e.g., VTI, VOO)

- Buy the ETF as you would a regular stock

- Hold and reinvest dividends for long-term growth

Best ETFs for Long-Term Investment Beginners USA

If you’re looking to invest for 10+ years, consider these:

- VTI: Great for total market exposure

- VOO or IVV: Stability and historical performance

- QQQ: High-growth tech sector

How to Choose the Right ETF for Beginners USA

Consider the following before investing:

- Risk Tolerance: VTI and VOO are lower risk; QQQ is higher risk

- Expense Ratio: The lower, the better

- Diversification: Broad market ETFs reduce individual stock risk

- Investment Goals: Long-term wealth vs. short-term gains

FAQs About ETFs for Beginners

Q1: What’s the best ETF to start with?

VTI is widely recommended for beginners due to its diversification and low cost.

Q2: How much money do I need to invest in ETFs?

You can start with as little as $50–$100 depending on your broker. Fractional shares make it even easier.

Q3: Are ETFs safe for beginners?

Yes, especially diversified ETFs like VTI or VOO. While no investment is without risk, ETFs are considered safer than individual stocks.

Q4: Can I lose money with ETFs?

Yes. Market downturns can affect ETF value. However, holding long-term helps smooth out volatility.

Q5: Do ETFs pay dividends?

Yes, many ETFs distribute dividends quarterly, which can be reinvested or withdrawn.

Conclusion: Best ETFs for Beginners in the USA

Investing in ETFs is a powerful way for beginners to grow wealth over time. With low costs, broad diversification, and ease of access, ETFs like VTI, VOO, and SCHB are excellent choices. Start small, be consistent, and watch your investments grow.

Want more personal finance tips and investment tools? Visit FinancialSpringboard.com and explore our expert guides for beginners!